What is the Part D Penalty?

MN Health Staff Writer | August 7, 2019

The Medicare Part D penalty is a late enrollment fee that is added to the monthly premium for your Part D plan.

How do you know if you owe a Medicare Part D late enrollment penalty?

After your initial enrollment period, if you go 63 consecutive days or longer without a Medicare Part D plan, a Medicare Advantage Plan, a different Medicare health plan that has prescription drug coverage, or any other valid prescription drug coverage you will owe a penalty.

How do you avoid the Part D penalty?

When you first become eligible for a Medicare prescription drug plan, join it.

Have creditable prescription drug coverage, whether it is from the Department of Veterans Affairs, employers, unions, health insurance coverage, or other providers.

Keep records that show you had credible drug coverage. Your plan will check if you had prescription drug coverage for 63 days or longer when you join a Medicare Part D plan. You may have to fill out a form if the plan does not think you had prescription drug coverage.

How do I know if I have a Part D late enrollment penalty?

When you join, your drug plan will inform you of your premium and if you incurred penalty. In most instances, you must pay this penalty for as long as you have the drug plan.

How do you request reconsideration on your Part D penalty?

If you would like to dispute a penalty, you may be able to request reconsideration. Talk to your drug plan carrier about the reconsideration process, complete the form within 60 days of the date on your letter from your plan informing you of your late enrollment penalty, and send the form with any records you may have that support your claim to the address on the form. On average, the Medicare contractor's reconsideration process takes 90 days. While waiting for the decision, by law, you must still pay the penalty and premium.

You got the Medicare contractor's decision, now what?

You and your drug plan will receive a letter from the Medicare contractor with their decision and explanation.

If the decision is that the penalty is wrong (partial or full), the drug plan will withdraw or reduce your Part D late enrollment penalty. Then, the plan will send you your new premium amount and if you will receive a refund for the penalty already paid.

If the decision is that the penalty is correct, you have to pay the penalty.

How much is my Medicare Part D late enrollment penalty?

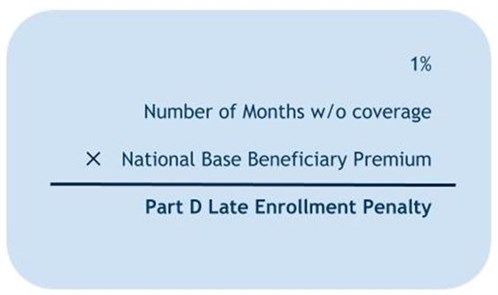

The amount your Part D penalty is dependent on how many months you went without prescription drug coverage or a Part D plan. Medicare takes the number of months you went without coverage and multiplies that by 1% of the national base beneficiary premium. The penalty is round to the nearest $0.10. The national base beneficiary premium in 2019 is $33.19.

Tags: